Fishing Tackle Excise Tax . The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. No matter how small your company is, if you are advertising baits for sale on this site or anywhere else, your best bet is to pay the tax. 31, 51, and 117) register for most. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. Action needed to improve compliance for sport fishing and archery imports. Manufacturers, producers, or importers of these. Another type of excise tax applies to specific sport fishing and archery equipment. Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. As a tackle shop you are either doing business with wholesalers/manufacturers who file an annual irs 720 (or otherwise pay excise taxes.

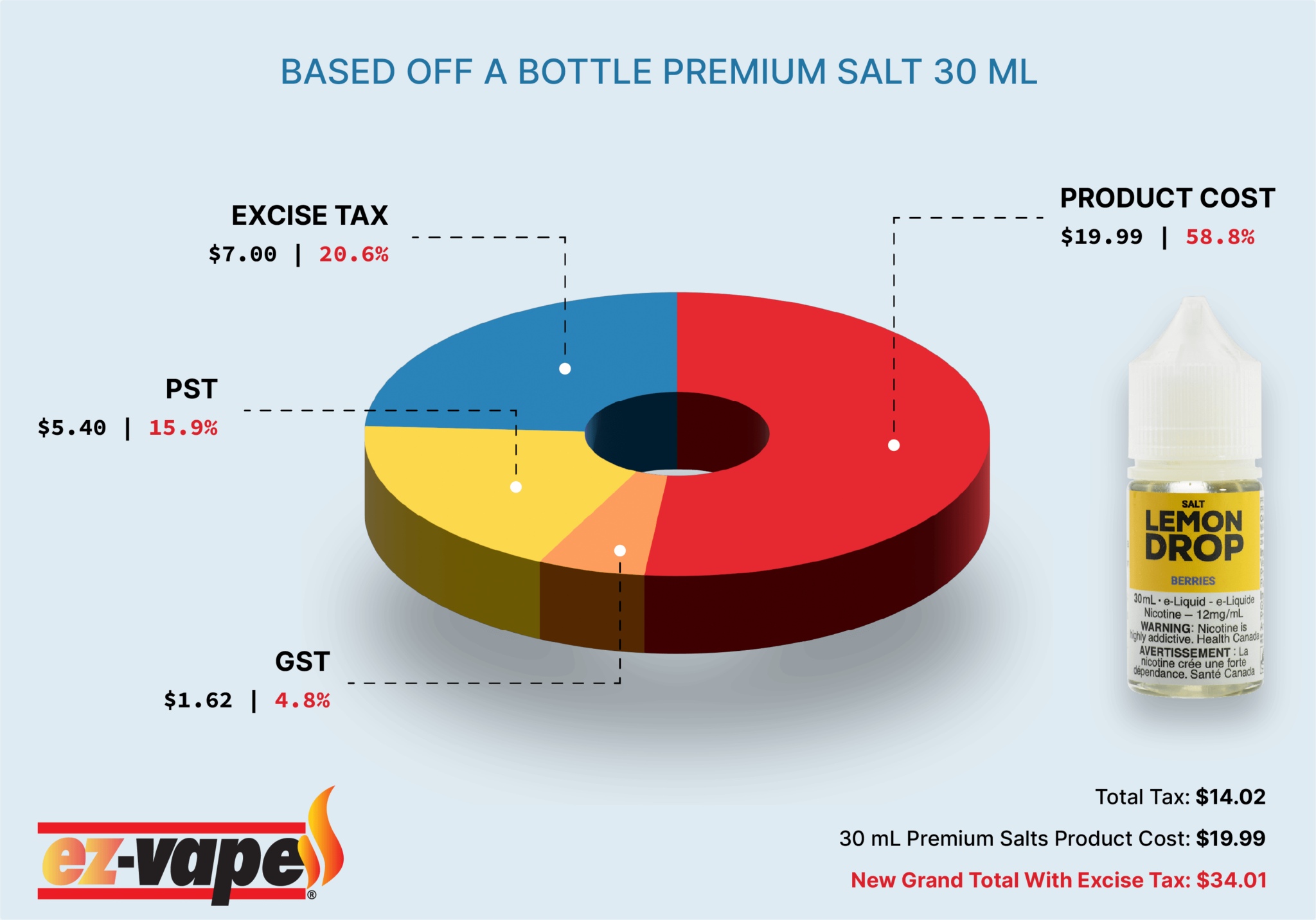

from ezvape.com

No matter how small your company is, if you are advertising baits for sale on this site or anywhere else, your best bet is to pay the tax. Manufacturers, producers, or importers of these. Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. As a tackle shop you are either doing business with wholesalers/manufacturers who file an annual irs 720 (or otherwise pay excise taxes. 31, 51, and 117) register for most. Another type of excise tax applies to specific sport fishing and archery equipment. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. Action needed to improve compliance for sport fishing and archery imports. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and.

Excise Vape Tax Canada Canadian Excise Tax EZVape

Fishing Tackle Excise Tax Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. Another type of excise tax applies to specific sport fishing and archery equipment. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. No matter how small your company is, if you are advertising baits for sale on this site or anywhere else, your best bet is to pay the tax. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. 31, 51, and 117) register for most. Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. Action needed to improve compliance for sport fishing and archery imports. As a tackle shop you are either doing business with wholesalers/manufacturers who file an annual irs 720 (or otherwise pay excise taxes. Manufacturers, producers, or importers of these.

From www.desertcart.fi

Buy Light Tackle Fishing Patterns of the Chesapeake Bay A Guide to Fishing Tackle Excise Tax Another type of excise tax applies to specific sport fishing and archery equipment. 31, 51, and 117) register for most. Manufacturers, producers, or importers of these. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows,. Fishing Tackle Excise Tax.

From wildlifemanagement.institute

Excise Tax Trends Looking Back Wildlife Management Institute Fishing Tackle Excise Tax 31, 51, and 117) register for most. Manufacturers, producers, or importers of these. No matter how small your company is, if you are advertising baits for sale on this site or anywhere else, your best bet is to pay the tax. As a tackle shop you are either doing business with wholesalers/manufacturers who file an annual irs 720 (or otherwise. Fishing Tackle Excise Tax.

From www.everycrsreport.com

The Sport Fish Restoration and Boating Trust Fund Fishing Tackle Excise Tax The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. 31, 51, and 117) register for most. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. As a tackle shop you are either doing business with wholesalers/manufacturers who file. Fishing Tackle Excise Tax.

From www.studocu.com

CPAR Excise Tax, DST (Batch 90) Handout EXCISE TAXES Atty. C. Llamado Fishing Tackle Excise Tax No matter how small your company is, if you are advertising baits for sale on this site or anywhere else, your best bet is to pay the tax. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. 31, 51, and 117) register for most. The internal revenue service (irs). Fishing Tackle Excise Tax.

From www.canadianlawyermag.com

Federal Court of Appeal tackles excise tax, international trade Fishing Tackle Excise Tax Manufacturers, producers, or importers of these. 31, 51, and 117) register for most. Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. As a tackle shop you are either doing business with wholesalers/manufacturers who file an annual irs 720 (or otherwise pay excise taxes. The internal. Fishing Tackle Excise Tax.

From partnerwithapayer.org

Research Improves Fishing Opportunities Thanks To Industry Fishing Tackle Excise Tax Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. Manufacturers, producers, or importers of these. Another type of excise tax applies to specific sport fishing and archery equipment. No matter how small your company is, if you are advertising baits for sale on this site or. Fishing Tackle Excise Tax.

From www.desertcart.lk

Buy Beginners Starter Coarse Float Fishing Kit Set 10ft Carbon Rod Fishing Tackle Excise Tax The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. As a tackle shop you are either doing business with wholesalers/manufacturers who file an annual irs 720 (or otherwise pay. Fishing Tackle Excise Tax.

From www.jsonline.com

Excise taxes continue to provide critical funds for fish, wildlife Fishing Tackle Excise Tax 31, 51, and 117) register for most. Action needed to improve compliance for sport fishing and archery imports. As a tackle shop you are either doing business with wholesalers/manufacturers who file an annual irs 720 (or otherwise pay excise taxes. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and.. Fishing Tackle Excise Tax.

From www.formsbank.com

Enhanced Food Fish Excise Tax Return Form 2002 printable pdf download Fishing Tackle Excise Tax Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. No matter how small your company is, if you are advertising baits for sale on this site or anywhere else, your best bet is to pay the tax. 31, 51, and 117) register for most. The internal. Fishing Tackle Excise Tax.

From rmn.ph

Pagsuspinde sa excise tax sa langis, muling ipinanawagan ng ilang Fishing Tackle Excise Tax Another type of excise tax applies to specific sport fishing and archery equipment. Action needed to improve compliance for sport fishing and archery imports. Manufacturers, producers, or importers of these. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. As a tackle shop you are either doing business with. Fishing Tackle Excise Tax.

From www.youtube.com

Excise Tax Short YouTube Fishing Tackle Excise Tax Another type of excise tax applies to specific sport fishing and archery equipment. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. Action needed to improve compliance for sport fishing and archery imports. Manufacturers, producers, or importers of these. No matter how small your company is, if you are. Fishing Tackle Excise Tax.

From sokodirectory.com

Resist The Ridiculous Excise Duty Spike Fishing Tackle Excise Tax Manufacturers, producers, or importers of these. Another type of excise tax applies to specific sport fishing and archery equipment. 31, 51, and 117) register for most. Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. The internal revenue service (irs) collects excise taxes from manufacturers, producers,. Fishing Tackle Excise Tax.

From forums.somd.com

SMC Proposed Excise Tax Southern Maryland Community Forums Fishing Tackle Excise Tax Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. 31, 51, and 117) register for most. As a tackle shop you are either doing business with. Fishing Tackle Excise Tax.

From blog.taxexcise.com

Advantages of Prefiling Form 2290 on Fishing Tackle Excise Tax 31, 51, and 117) register for most. Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. As a tackle shop you are either doing business with. Fishing Tackle Excise Tax.

From thefishingwire.com

Excise Taxes on Tackle a Catalyst for Coastal Conservation The Fishing Tackle Excise Tax 31, 51, and 117) register for most. Manufacturers, producers, or importers of these. Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. As a tackle shop you are either doing business with wholesalers/manufacturers who file an annual irs 720 (or otherwise pay excise taxes. No matter. Fishing Tackle Excise Tax.

From www.eregulations.com

Department of Natural Resources Board South Carolina… eRegulations Fishing Tackle Excise Tax No matter how small your company is, if you are advertising baits for sale on this site or anywhere else, your best bet is to pay the tax. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and. Fishing Tackle Excise Tax.

From wildlifemanagement.institute

Excise Tax Update Final FY2018 Collection Data Wildlife Management Fishing Tackle Excise Tax Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. Manufacturers, producers, or importers of these. Another type of excise tax applies to specific sport fishing and archery equipment. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport. Fishing Tackle Excise Tax.

From ezvape.com

Excise Vape Tax Canada Canadian Excise Tax EZVape Fishing Tackle Excise Tax Irc 4161 imposes an excise tax on the sale of sport fishing equipment, bows, archery equipment and arrow shafts (exception for certain wooden. Another type of excise tax applies to specific sport fishing and archery equipment. The internal revenue service (irs) collects excise taxes from manufacturers, producers, and importers on the sale of sport fishing and. The internal revenue service. Fishing Tackle Excise Tax.